Abstract

The Founding Fathers provided India with a Union Constitution and a model of federalism, which is now distinctively know as a ‘union model of federalism’. It distinctively harmonises otherwise opposite processes of (i) centralisation-decentralisation; (ii) autonomy-integration, and unionisation- regionalisation. The degree of federalism varies from Article to Article and from one context to another. One finds a consistency in the relative degrees of centralisation and decentralisation. Powers are distributed in a manner as to promote federal nationalism and regionalism, besides being an ethnically responsive federal polity. With the introduction of Goods and Services Taxes (GST) and the National Institution for Transforming India (NITI Aayog) and growing salience of subject specific regulatory bodies, Indian federalism is gradually shifting towards a system of national governance, which I have termed ‘National federalism’. This contribution succinctly analyses these aspects of Indian federalism.

Introduction

The Founding Fathers of India drafted a ‘union constitution’ and crafted a polity which they termed as a ‘federation with a strong centre’, which I have described as the union model of federalism. As a model, it critically synthesizes the best of theories of dual federalism (dual polity and sovereignty of jurisdictions, protected by an independent judiciary); organic- interdependent federalism (marked by reciprocal dependence of polities, structurally networked in a matrix); and cooperative- collaborative federalism (common policy governance, and institutionally mediated resolution of competing claims and conflictual interests). From a deconstructed reading of constituent assembly debates, the founders’ perspectives on Indian federalism can be briefly summed up as the following:

- Federalism is a freedom promoting diversity, retaining unity and promoting constitutional instruments. It would essentially serve as a means for the promotion of nationalism, democracy and justice.

- As the federal units are created by the union, they would not have any pre-determined contractual rights.

- The federation was to be known as a union, ensuring the organic unity of people and polities.

- The division of powers would be premised on the twine principles of autonomy and integration of jurisdictions.

- Assignments and sharing would be the governing idioms of financial relations.

Constitutionally, the union model works on the critical balancing and contextual application of otherwise opposite processes of (1) unionisation – regionalization; (2) centralisation- decentralisation, and (3) autonomy- integration. Unionisation is a process of pooling together of sovereignty and nationalization of resources. Regionalization recognizes pluralism as a valid basis of the formation of polities and decentralized governance. Centralisation refers to the contextual and circumstantial transfer of powers from the state level to the centre. Delegation, devolution and de-concentration are constitutional instruments of decentralisation. Autonomy has variegated applications ranging from autonomy to institutionalization of multiculturalism and self-determination principles (except a right to secession). The Constitution provides for several institutional models/forms of autonomy, intended to accommodate ethnicity. It is further extended to facilitate development of backward regions through the principles of first claim (of native/local people) on state resources and jobs, and through the mechanism of special grants and economic packages. Integration is a process of creating a ‘federal nation’ through the instruments of shared rule institutions such as the Six Zonal Councils, Inter State Council, National Development Council etc., and through other policy measures like the three language formula, common citizenship, and common administrative apparatuses, common court and civil laws etc.

For a strong centre, the Constitution grants some special powers to the centre. They are:

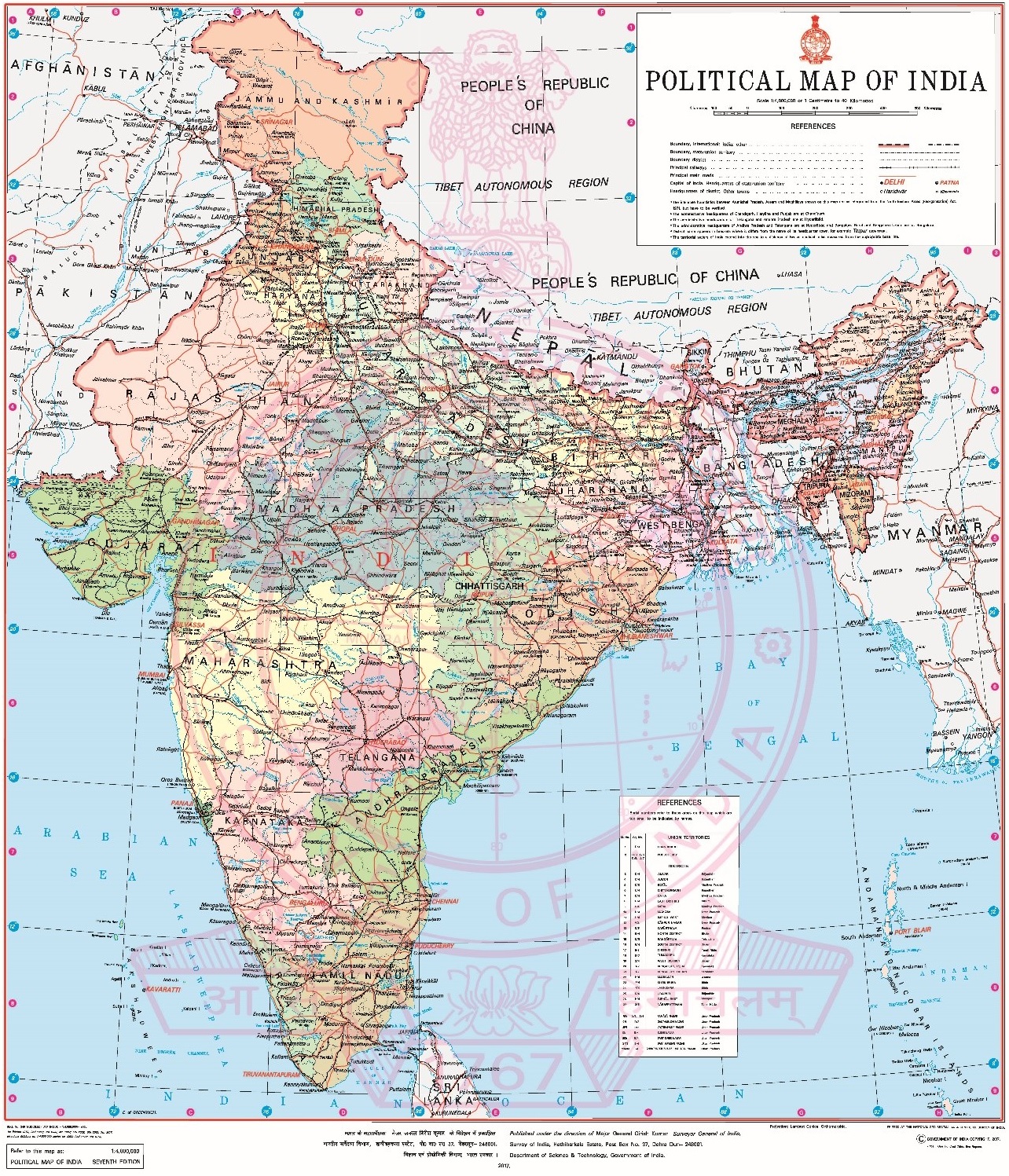

- Formation of federal units through internal boundary changes. The Indian federation now comprises of 29 states and 7 union territories, governed either independently as semi-autonomous regions with directly elected legislative assemblies (e.g., Delhi or Puducherry) but with limited autonomy, and extensive union control, or directly governed by the union government. The Constitution does not provide any ceiling on the number of states/ polities.

- Vesting of residuary powers with the centre.

- The centre has the constitutional mandate to issue directions to the units to perform specific tasks.

- The application of emergency powers in the event of a breakdown of the constitutional machinery in an autonomous state.

- The nationalization of resources, including inter-state resources in the national interests and public welfare.

(Survey of India)

Powers between the centre and states are divided on a combination of factors such as territoriality, subsidiarity, national unity and security, techno-economic cost and capabilities, economic and administrative efficiency, equity and economies of scale etc. India follows a list system. (Singh, 2015). The Union list comprises 98 (originally 97) subjects on which the union has exclusive competence. States have either exclusive or conditional competence over 59 subjects (originally 67). The union and states have co-sharing competence over 52 subjects (originally 57). But in case of repugnancy, union law prevails over state laws. The Indian constitution innovates with the notion of ‘field occupancy’ allowing multi-functional and multi- jurisdictional governance of a subject. Executive authority of the central and state governments is generally coextensive with their respective legislative competence.

The Constitution does provide for asymmetrical relations especially with respect to states like Jammu & Kashmir, Assam, Nagaland, Mizoram, Meghalaya and Manipur. Summarily, provisions of Articles 370, 371, 371 A-H, fifth and sixth schedules restrict the application of many union laws and constitutional provisions. The 73rd and 74th constitutional amendment acts factorize intra-state federalism by validating Gram Panchayats and Municipal Councils as a third tier of governance. Besides being instruments of social engineering and participatory democracy, villages now serve as the primary unit of regional, state and national planning.

Fiscal Federalism

Equity, capacity, stability and growth are four important pillars of fiscal federalism in India. The Union is also expected to create level playing fields across jurisdictions. Constitutional economics is further marked by policy overlap and fiscal interdependence (Rao and Singh 2005: 152). The Constitution assigns all progressive, buoyant and productive tax handles to the union government. The Union is also the regulator of fiscal disciplines, natural resources, expenditure austerity, debt, loan and external borrowings by the states. Direct taxes assigned to the centre include corporation tax, income tax, and major indirect taxes include excise and custom duties and service taxes. “Major sources of non-tax revenue of the union government are interest receipts from the states and central public-sector enterprises…dividend receipts, user charges, royalty from off shore oil fields, profit petroleum and receipts from the telecom sector.” (XIV FC Report 2015: 31). The constitution empowers the union level to levy sector specific cesses and surcharges. Since 2012, it accounts for about 14 percent of the total revenue receipts of the centre. They do not form part of the divisible pool.

There are three major sources of state’s revenue. First, own tax revenue including sales tax, excise duties, registration and stamp duties, taxes on motor vehicles, electricity duty, land revenue, profession tax, entertainment tax and other sundry taxes. Second, non-own tax revenue (interest receipts, dividends and profits from state enterprises, user and service charges). Third, a share in central taxes and plan assistance and other discretionary central transfers. This includes the Finance Commission (FC) transfers (share in net proceeds of the union, also known as statutory transfers, and grants), formula based Planning Commission transfers, a ratio based grants, (70:30 in the case of general category states and 90-10 in the case of special category states) who on account of fiscal disabilities (physical and cost disabilities) lag behind national averages in terms of economic growth, provision of welfare goods and services and competitive developmental capacities) and loans, sector specific ministerial grants etc. Most of the grants are conditional which in a way restricts the expenditure options of the states. While statutory transfers come as constitutionally sanctioned claims of states, Planning Commission transfers are mostly guided by politico-economic preferences of the government of the day, and developmental compulsiveness of the union as a whole.

Constituted every five years, the Finance Commission transfers are predominantly in the form of tax devolution and, to lesser extent, grants. The grants include non-plan revenue deficit grants, grants to local bodies, grants for disaster management, sector specific grants and state specific grants. The Finance Commission grants accounted for 11 percent of the revenue transfers in the FC-XI (2000-05) period and the FC-XII (2010-15) raised the share to over 12 percent. However, it declined to 9.5 percent in the FC-XIII (2010-15) award period. (XIVth FC Report 2015: 50). The fourteenth FC considerably raised the share of tax devolution to 42 percent of the divisible pool. Out of the total central transfers, the Finance Commission transfers on average around 65.98 percent during the periods from FC VIII (1984-89) to FC –XII (Computed from table 5.1 of the XIV FC Report 2015: 50). During the same period, plan and non-plan grants average to around 34 percent. A look at the states’ own tax revenue shows that “value added tax (VAT) has constituted around 61 percent of aggregate own tax revenues of the states… during the period 2004-05 to 2012” (XIV FC 2015: 41).

Emerging National Federalism

Building upon the conceptual resources of Gluck (2014), and Gerken (2014), the current phase of Indian federalism can be described as a phase of national federalism. Since 2015, Indian federalism has undergone two major defining changes -(i)NITI Aayog (National Institution for Transforming India) replacing the Planning Commission through a cabinet resolution dated 1st January 2015, and, (ii) the rolling out of Goods and Service Taxes on 1st July 2017, and the establishment of a supra fiscal assembly known as the GST Council.

Also since 2015, major structural reforms related to regulatory institutions have been introduced through a new Finance Bill, delegating substantive rule making authority to the central government. Generally, such changes have to be effected through amendments in the parent law where parliament has substantive control to shape, modify and change the outcome of such amendment. In this context, it is prudent to point out that “while a bill requires parliamentary approval in order to be enforced. Rules do not.” To illustrate, “the Finance Bill, 2017 allows the central government to specify the appointments, tenure, removal, and reappointment of chairpersons and members of tribunals through rules” (Kala 2017: 9). Similarly in 2016, besides amending several important central acts like the Foreign Exchange Management Act 1999, the Money Laundering Act 2002 etc., the Finance Bill constituted a monetary policy committee (originally a subject of regulation by the Reserve Bank of India) to determine the policy rate required to achieve the inflation target. Its members are appointed by the central government and it amounts to delegating more and more powers to the hands of the executive.

What is being argued here is that the statutory and non -statutory spaces are used to centralise federalism, where the sovereignty of states is either concentrically posited in the central executive or is pooled together at the national level for creating policy conformity in order to develop India as a national state through new institutional arrangements of national governance. Unlike the cooperative–competitive phase, marked by autonomy of choices, initiatives and competitive leverages of the states, national federalism shifts the locus of sovereignty from state capitals to the national capital where choices are rarely politically negotiated, but rather decided through the compulsiveness of techno-bureaucrats and the monopoly of resources by the centre. “Strong nation and strong states” is the key slogan of national federalism. This is evident from the deconstructed analysis of business procedures, agenda and minutes of twenty-five meetings of the GST Council held so far. National federalism is qualitatively different from the discursive logic of the unionisation process whose preferred catchphrase is/was “a strong centre and strong states.”

Unlike the USA, national federalism in India is promoted not through parliamentary majority but through parliamentary bodies, such as the GST Council and national policy institutions like NITI Aayog, which centralise the constitutional competences and sovereignty of states on subjects like agriculture, land, health and sanitation, education etc. Interestingly, national federalism is generally rationalized in the name of cooperative federalism and good governance and to develop India as a global nation having sufficient international diplomatic and economic leverage.

NITI Aayog

The NITI Aayog document on Competitive Co-operative Federalism (2016) forcefully argues for the development of “a shared vision of national development priorities, sectors and strategies with the active support of states” (p. 15). Centralising states’ capacities is its foremost strategy of national development. Hence, it is an intrusion in the areas of competence originally reserved for states. It has defined its role as national planner and agenda setter. Its other mandates include (i) the formulation of “credible plans at the village level and aggregate these progressively at higher levels of government”; (ii) the development of long term strategy of development and its monitoring; (iii) the resolution of “inter-sectoral and inter-departmental” issues for smooth implementation of development agenda; and (iv) “ advocacy of state perspectives with central ministries”.[1]

It has been designed to serve as a policy advisor, knowledge hub and resource centre of the central government. Its governing council, comprising of chief ministers of all states, Lt. Governor of union territories, full time members, nominated union ministers and experts, is headed by the Prime Minister, who is also the chairperson of the Aayog.

Goods and Services Taxes (GST)

India has moved from the initial constitutional regime of sales tax to Value Added Tax (VAT) in 2005 and now to GST on 1st July 2017. Acting as a unifier, it seeks to create “a single national market, common tax base and common tax laws for the centre and states.” Unlike VAT, GST is a destination based tax, imposed on the supply chains of goods and services. It is a dual levy system where the central government levies and collect central GST (CGST) and the state levies and collect state GST (SGST) on intra-state supply of goods or services. The centre also levies and collect Integrated GST (IGST) on inter-state supply of goods or services.

GST Council

Pursuant to the Constitution (One Hundred and First Amendment) Act, 2016, dated 8 September 2016, the GST Council, comprising of union finance ministers and state finance ministers, has been constituted to “recommend on the GST rate, exemption and thresholds, taxes to be subsumed and other features,” besides suggesting a mechanism to resolve disputes related to GST between the centre and states, or among states. One half of the total number of members constitutes a quorum for the meeting of the council. Decisions in the Council are taken by a majority of not less than three-fourth of weighted votes cast. “Centre and minimum of 20 States would be required for majority because Centre would have one-third weightage of the total votes cast and all the States taken together would have two-third of weightage of the total votes cast” (GST – Concept & Status 2018:2-3).

Conclusion

The Union model of Indian federalism has gradually evolved to create a distinctive framework of federal governance of resources and diversity. Over the years, it has successfully created a matrix of self-rule and shared rule institutions. As a model, it uniquely blends the ideas of federalism, nationalism and multiculturalism. The constitution has innovated and adopted a list system of power distribution, where the degree of autonomous competence varies contextually and circumstantially. Asymmetry is promoted to accommodate diversity. Recently, India has switched over to GST-“a single national market, common tax base and common tax laws for the centre and states.” NITI Aayog is engaged in creating a common national policy framework across the seventh schedule of the constitution. The current phase of federalism may be appropriately termed as a phase of national federalism where the locus of sovereignty has shifted from state to centre. It is being officially rationalised as a cooperative federalism.

Suggested citation: Singh, A.K. 2018. ‘The Union Model of Indian Federalism’. 50 Shades of Federalism. Available at: http://50shadesoffederalism.com/case-studies/union-model-indian-federalism/

Bibliography

“GST – Concept & Status,” updated as on 01st March 2018 http://www.cbec.gov.in/resources//htdocs-cbec/gst/01032018-GST_Concept_and_Status.pdf

Gluck, Abbe R. 2014. “Our [National] Federalism”, The Yale Law Journal, vol.123, no 6 (April, 2014), 1996-2043.

Gerken, Heather K. 2014. “Federalism as the New Nationalism: An Overview”, The Yale Law Journal Vol. 123, No. 6(April, 2014). 1889-1918

Gluck, Abbe R. 2014. “Our [National] Federalism”, The Yale Law Journal, vol.123, no 6 (April, 2014), 1996-2043

Kala, Manidra. 2017. “How Finance Bill Amendments Affect Tribunals”, Indian Express, New Delhi, March 27.

Rao, M Govinda and Nirvikar Singh. 2005. Political Economy of Federalism in India. New Delhi: Oxford University Press.

Report of the Commission on Centre State relations 1988, Part I. New Delhi: Manager, Govt. of India Press, 2007.

Singh, A K. 2005/2009. Union Model of Indian Federalism. New Delhi: CFS & Manak Publications.

—. 2015.’ Constitutional Semantics and Autonomy within Indian Federalism’ in Francesco Palermo and Elisabeth Alber. eds. Federalism as Decision Making: Changes in Structures, Procedures and Policies. Leiden &Boston: Brill Nijhoff.

Further Reading

Austin, Granville. 1972. The Indian Constitution: Cornerstone of a Nation. New Delhi : Oxford University Press.

Dhavan, Rajeev and Rekha Saxena. 2006. ‘Republic of India. In Legislative, Executive and Judicial Governance in Federal Countries’, ed. Katy Le Roy and Cheryl Saunders, 165-197. Montreal & Kingston: McGill-Queen’s University Press.

Jain, M P. 2014. Indian Constitutional Law (7th edn). Gurgaon: LexisNexis.

Majeed, Akhtar. 2005. ‘Republic of India. In Constitutional Origins, Structure, and Change in Federal Countries’ ed. John Kincaid and G. Alan Tarr, 180-207. Montreal & Kingston: McGill-Queen’s University Press.

Saez, Lawrence.2002. Federalism without a Centre: The Impact of Political and Economic Reform on India’s Federal System. New Delhi: Sage Publications.

[1] (For details visit web-folios at http://www.niti.gov.in)