Abstract

Somalia is a federal country with established Federal Member States (FMS). In the absence of a finalized constitution, a political settlement over power and resource allocation is lacking, leading to extra-constitutional negotiations. A nascent federal system with a provisional constitution poses major constraints on the functioning of the government and citizens’ trust. This includes inter alia the inability to provide services across the jurisdictions, conflict over limited resources, constrained human resources, election disputes, limited understanding of federalism, corruption, and clashes. A political settlement would help Somalia’s stabilization and sustainable development. The current political leaders have created avenues for political negotiations that help reach consensus on contentious issues. These avenues are laying the foundation for political dialogue, leading to compromise on many unresolved issues that are proving successful and a model for post-conflict settings.

Problem-setting

British Somaliland and Italian Somaliland united in 1960 to form the Republic of Somalia and through a popular referendum adopted a new constitution in July 1961. A military coup led by General Mohamed Siyad Barre took place in 1969 and ruled the country until its eventual collapse in 1991. After the collapse of the state, Somaliland in the northwest declared independence and Puntland in the northeast established a semi-autonomous state. The remaining southern parts of Somalia which today comprises four new Federal Member States were administered by clans, religious administrations, or locally established government administrations.

To avoid the re-emergence of an authoritarian central government, federalism was proposed as a common governance structure in 2004 under the Transitional Federal Government which was the first internationally recognized transitional government since the collapse of the state in 1991.

Subsequently, a provisional federal constitution was adopted in 2012 leading to the formation of the Federal Government of Somalia (FGS). The provisional constitution allowed two or more regions to merge and form a Federal Member State. Currently, Somalia has five Federal Member States namely: Puntland, Jubaland, Southwest, Galmudug, and Hirshabelle, one self-declared independent Republic called Somaliland and the Banadir Regional Administration which is the seat of the federal government and the capital of the country.

The provisional constitution still has major gaps which are fundamental in a federal model of governance. The distribution of powers and assignment of resources across levels of government are not defined. The constitutional review process led by the federal government is still conducting stakeholder engagement, and it has gone through the 9th and 10th parliament without completion.

Due to the absence of government for prolonged periods (1991 – 2012), service provisions with revenue potential such as water, electricity, schools, and hospitals are provided by the private sector or non-state actors creating unequal access. The government authorities have little capacity to oversee or regulate services provided by the private sector which impacts their legitimacy and relevance.

The Case for Revenue-sharing

The Federal Government of Somalia and the Federal Member States are not self-sufficient in funding their expenditure needs and rely on external financing to balance their budget. Expenditures are dominated by administration and security, with limited fiscal space to allocate resources to other sectors.

Revenue-raising capacity is limited and uneven at all levels of government. Therefore, sub-national governments rely on intergovernmental transfers to operationalize their budget.

The local level of government is largely absent from the constitutional review process and intergovernmental fiscal federalism discussions. The focus is on federal and state relations. However, many studies in Somalia (Cloutier et.al. 2022) show that legitimacy is highest at the local level which makes its involvement and consideration important in the ongoing dialogue.

As the state-building process is taking shape, weak institutions, and a lack of capacity at all levels of government will continue to limit the role of the state in providing such services. Therefore, the federal member states are required to choose carefully which functions they can provide because of limited resources and capacity.

The division of resources between levels of government is becoming an increasingly contentious issue that is slowing down the constitutional settlement process. Each level of government is setting, collecting, and utilizing domestic revenue in its jurisdiction, including international trade taxes.

The authorities that oversee operational ports, such as the Federal Government of Somalia, Puntland State of Somalia, and Jubbaland State of Somalia, collect more domestic revenue than those that do not have operational ports, such as Southwest State of Somalia, Galmudug State of Somalia, and Hirshabelle State of Somalia.

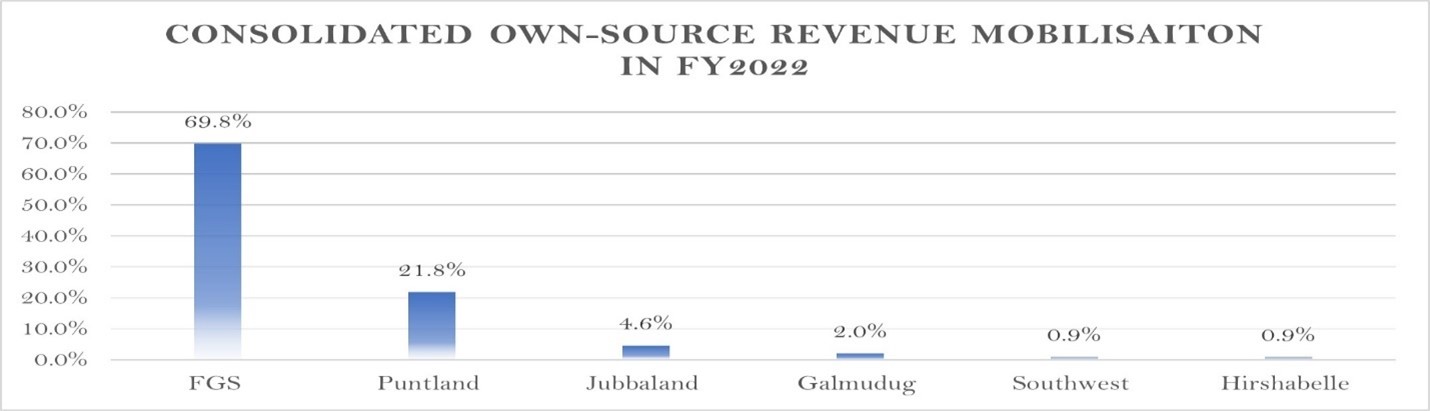

Source: FY 2022 share of total own-source revenue collected across the federal units.

The share of own-source revenue collected in FY2022 and deposited in the treasury single accounts was highest in the FGS, covering 69.8 percent of the total own-source revenue collected across the authorities. In comparison, Southwest and Hirshabelle each accounted for only 0.9 percent of the total own-source revenues collected.

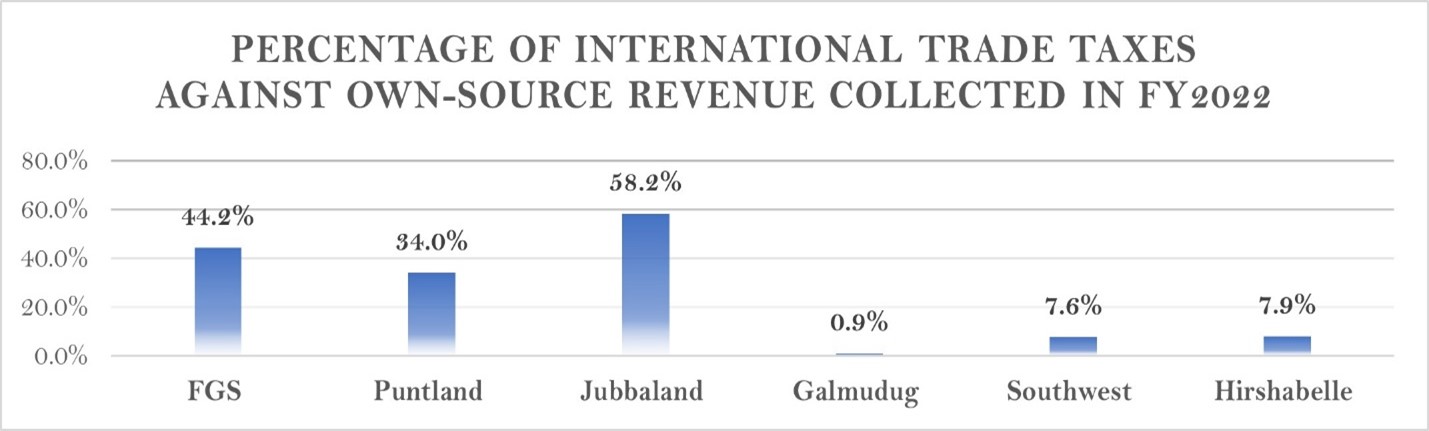

Source: Fiscal reports from government published reports

The main reason for the disparity is that international trade taxes in FGS, Puntland, and Jubbaland account for 44 percent, 34 percent, and 58 percent of their own-source revenue collected respectively in FY2022 while amounting to less than 8 percent in the other States. The disparity in revenue potential is one of the issues that is constantly brought about in negotiations and discussions which affects ongoing intergovernmental discussions.

The formation of intergovernmental platforms to discuss challenges and propose solutions through technical engagement has proved effective and interim agreements that are yet to be decided are reached.

Building Trust through Intergovernmental Platforms

The national and sub-national governments have established an intergovernmental body called the National Consultative Council which is led by the Federal Government of Somalia President and its members include the Prime Minister, Deputy Prime Minister, the five Federal Member States Presidents, and the Governor of Banadir Regional Administration.

The National Consultative Council reached a political agreement on the functions and revenue assignments between the federal, state, and district governments. This political agreement is a key milestone that lays the foundation for other stakeholders to engage broadly on how to operationalize it.

The Ministries of Finance from the federal, the state, and representatives from Banadir Regional Administration have also established an intergovernmental platform to discuss fiscal federalism matters in November 2015.

The platform comprises two levels. A technical committee level led by the Director Generals from federal, state, and Banadir regional administration with relevant departments of the Ministry of Finance participation known as the Intergovernmental Fiscal Federalism Technical Committee. This technical platform provides researched options to a higher policy level led by Finance Ministers known as the Finance Ministers Fiscal Forum.

The platform proved very useful as it allowed the finance ministers to hold structural discussions on topics such as harmonization of revenue laws and policies, provide predictable intergovernmental transfers, improve reporting of funds utilization, de-politicize technical discussions, and seek technical assistance from development partners and within government to support agreed reforms.

Some of the key agreements reached include the implementation of a unified chart of accounts, approval of a grant formula for budget support with performance parameters to incentivize agreed reforms, harmonization of customs procedures and regulations, allocation of transfers to support service delivery, and agreement on expenditure and revenue functions that will feed into the constitutional review process.

The intergovernmental platform opened new possibilities as trust was built, intergovernmental transfers became more predictable, prejudices that existed were addressed, and a common vision was crafted to move the country forward. This does not mean that there are no conflicts from time to time, but the intergovernmental platform provided an avenue to address them.

Subsequently, intergovernmental transfers from the FGS to the FMS increased over the years and became more predictable. Transfers increased from 12 percent in 2019 to 39 percent in 2022. This represents a total transfer of USD 20,396,028.71 in 2019 to USD 67,303,370.26 in 2022.

More consistent and predictable rule-based transfers are expected to improve service delivery to the citizens and act as a springboard to better agreements. For example, as the COVID-19 pandemic affected domestic revenue mobilization across the country, the intergovernmental forum was able to broker increased transfer allocation to the FMS. This was crucial in supporting the fight against the pandemic by the FMS.

The incomplete political settlement and lack of trust continue to pose risks to the success of the intergovernmental structures. Emerging and unpredictable political differences can lead to the postponement of scheduled intergovernmental meetings or lack of quorum to reach agreements. Therefore, it is important to focus on the processes and not just the outcome to push for incremental progress in Somalia.

We must point out that it is such platforms that allow political leaders to come together and discuss contentious issues in a structured manner in the absence of a final constitution and political settlement. Sometimes, one issue can take up to six months to reach a political agreement. However, sticking to such a format yields results in the long run.

There are important lessons on state-building in post-conflict settings that can be learned from Somalia:

- In the absence of a complete political settlement, a sustained dialogue using structured platforms, such as the intergovernmental one in Somalia, yields results. These interim agreements will ultimately influence a final political settlement.

- Progress is non-linear and incremental. However, there are distinct opportunities to be seized upon by both political and technical structures.

- The establishment of a strong technical platform to support evidence-based policy dialogue is crucial to develop implementable agreements.

Suggested citation: Yasin, M. 2023. ‘Building Trust and Foundations for Fiscal Federalism in Conflict-affected Somalia’, 50 Shades of Federalism

Further Reading

Alma Nurshaikhova, Gael Raballand, Mohamud Yasin Jama. 2023. Revenue Sharing as a Basis for a Sustainable Federal System in Somalia. IFF Working Paper Online No 34, Fribourg. Available at: https://folia.unifr.ch/unifr/documents/325231

Mathieu Cloutier, Hodan Hassan, Deborah Isser, and Gael Raballand. 2022. Understanding Somalia’s social contract and state-building efforts. United Nations University.