Abstract

After decades of decentralization, interprovincial inequalities in Argentina continue to be high, which is evidenced by the differences in socioeconomic indicators, and an absence of long-term policies, given the different investment provinces have been making on key social policies such as health, education and housing. The constitutional reform of 1994 and subsequent changes were not capable of correcting these vertical and horizontal imbalances in the federation; on the contrary, the basic institutional characteristics of the Argentine political system facilitate opportunistic and clientelistic behaviour of actors involved, which translates in a lack of intergovernmental coordination. This article aims to analyse the intergovernmental coordination between the federal level and the provincial levels in the management (design, implementation and financing) of public health, housing and education policies in Argentina in the period 2003-2018. In doing so, the paper describes the operation of the vertical IGRs in the management of three selected social policies: health, education and housing policies.

Introduction

Argentine federalism has experienced an important process of decentralization in the last decades. The increasing participation of subnational governments in public spending since the 1960’s reflects an ongoing process of decentralization. Intergovernmental relations have acquired different characteristics over these six decades (see Altavilla 2018). Nevertheless, conflict – rather than cooperation – is still being the main feature of national and provincial relations regarding the complex federal transfer system and the federal co-participation regime in particular (Altavilla 2016). The lack of effective mechanisms of coordination and the absence of long-term agreements are persistent features. These issues put co-participation regimen and the fiscal federalism on the agenda of each new government.

The result of long and complex process of negotiations between both levels of government, the current co-participation regime shows a high degree of redistribution (Altavilla 2014). After two decades of basic social policy decentralization, it is now time to determine whether decentralization has contributed to reduce development gaps and inequality among provinces.

The Argentine Federation and Subnational Governments

The Argentine federation is composed of a federal government, 23 provinces, an autonomous city, Buenos Aires (that is at the same time, the capital of the nation) and nearly 3000 local governments. The Autonomous City of Buenos Aires (CABA) is, largely, similar to a province. Provinces, municipalities and CABA have their autonomy constitutionally recognized (sections 5, 123, and 129, respectively). This article is focused only in relation to provinces (including CABA) and the federal government.

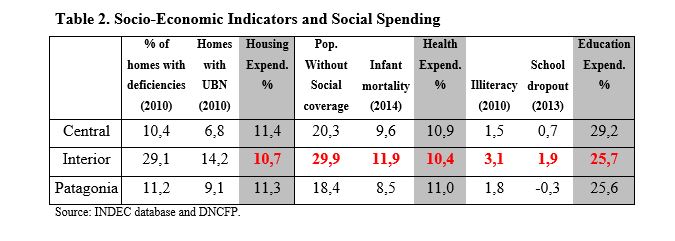

In order to simplify the analysis, the 24 subnational entities have been divided into 3 groups, according to their population, economic growth and their performance in a series of socio-economic indicators: The Central region (also known as Pampa region), the Interior and the Patagonian region. They also coincide in their geographic location (see Map).

(Source: D-maps)

Argentina is a country historically characterized by a high level of asymmetries and disparities among its constituent parts. This historical trend has shown that there is an ever-widening gap between provinces and regions and that has so far changed very little, without any substantive changes in the recent years (Cetrángolo and Goldschmit 2013).

These asymmetries can be seen in four variables: (a) Population; (b) Gross Geographic Product (GGP); (c) Tax collection; and (d) Socio-economic indicators.

(a) Population: the largest percentage of population of the country is concentrated in the central region: together, these provinces represent 66.7 per cent of the population of the entire country, while Interior represents 28.3 per cent and the Patagonian region makes up 5.2 per cent (according to the 2010 Census). These numbers have been stable since the 1914 national census. Most of the population are concentrated in the central region, the so-called Pampa region, one of the most fertile lands of the world. We find here in this region the most populated cities (Buenos Aires, Gran Buenos Aires, Córdoba, Rosario, Mendoza). The remaining 19 provinces together represent 31.9 per cent of the total population. There is a huge gap between these two groups. For instance, only the district of La Matanza, in the Province of Buenos Aires, with 1,772,130 inhabitants has more population than those 19 provinces taken together.

(b) The Gross Geographic Product (GGP): the gap between the most developed provinces and those less developed is breath-taking: the central provinces represent 83.9 per cent of the GDP, the Interior 12.6 and Patagonia 3.5 per cent (average between 1993 and 2006). This means that five jurisdictions represent 84 per cent of the GDP, while the remaining 19 provinces only account for 16 per cent.

(c) The Provincial tax collection: those asymmetries are reflected in differences of provincial tax collection. Of course, less population means less economic activities and consequently, fewer revenues from taxes. There are two kind of asymmetries: vertical asymmetries, between the federal government and the provinces, and horizontal asymmetries, among provinces. Argentina evidences a high asymmetry in both aspects, horizontal and vertical. Firstly, vertical asymmetry means a high centralization of tax competences. Indeed, the Federal government collect almost 90 per cent of current taxes in the country (nearly 30 taxes), while provinces only levy four taxes. Their impact on GDP is very low in relation to federal taxes. Provincial tax burden represented 5.63 per cent of GDP in 2012, while Federal taxes accounted for 31.7 per cent – five times bigger than the consolidated provincial tax burden. Secondly, the horizontal asymmetry means that tax autonomy rate varies highly among provinces and, consequently, they are less or more dependent on federal transfers. As will be analysed in more detail below, Central provinces cover 50 per cent of their budgets with their own resources (local taxes), Patagonia 30 per cent and the Interior provinces only 15 per cent.

(d) Socio-economic indicators: As is discussed below in more depth, socio-economic indicators also vary among these three groups. Central provinces have the highest rates in each of the six socio-economic indicators selected, followed by the Patagonian provinces. Finally, the Interior provinces show the worst performance in this field, having the lowest rates.

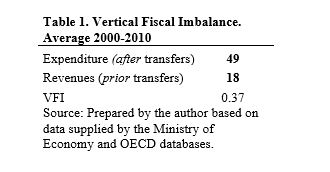

The Fiscal System: Tax Allocation and Federal Transfers

Argentine federalism is highly centralized from the fiscal aspect: the vertical fiscal imbalance in the country was (in average between 2000-2010) 0.37 points. When the ratio obtained is lower than 1.0, it means that subnational units do not cover their expenses with their own resources (i.e., locally raised taxes). Conversely, if the ratio exceeds 1.0, it means that subnational governments receive more money than they spend (Swenden 2006 :112). A ratio of 1.0 indicates a perfect vertical balance.

A ratio of 0.37 means that Argentine subnational governments do not cover their expenses with their own resources; on the contrary, they rely upon federal transfers to pursuit and fulfil their constitutional obligations and competences.

The differences among provinces in tax collection is also striking. Analysing data for the fourth semester of 2015, regarding the tax collection by jurisdiction, of both levels of governments (national and provincial)[1], it shows thatthe five wealthiest collect 88.9 per cent of all taxes, while in the remaining 19 jurisdictions only 10.8 per cent are collected.

The most important federal transfer is the so called “co-participation regime”. The current co-participation regime was enacted by the 1988 law (Law No 23.548) and basically, establishes that all (direct and indirect) taxes levied by the federal government shall be shared with provinces. All revenues taxes collected by the federal administration form a common pool, which is distributed in two steps: first, a primary distribution between the federal government and all the provinces together, taken as a unit: 42.34 per cent for the federal government and 54.66 for provinces; the remaining 2 per cent forms a special fund aimed to compensate some provinces and 1 per cent constitutes a special fund called ATN (for its Spanish acronym, Aportes del Tesoro Nacional), contributions from the federal treasury.

Then, a second distribution takes place (a secondary distribution) among the 23 provinces and CABA. Section 4 establishes the percentage corresponding to each one of them. These percentages are fixed by law, and they have not been changed over time. After three decades this co-participation regime law entered into force, those percentages do not represent the current situation of the federation and they are, therefore, outdated, which constitutes an important problem in the Argentine fiscal federal system.

The co-participation regime represents a very significant proportion of provincial resources. Between 2003 and 2018, co-participation revenues represented 71.9 per cent of total federal transfers, while the remaining federal funds represented 28.1 per cent.

Revenues coming from the Co-participation regime represent an important percentage of provincial budgets: on average between 2003 and 2010, the revenues from this regime represented 43.7 per cent of the total provincial budgets, while others federal transfers represented 16.4 per cent. The provinces cover the remaining 39.9 per cent of their budget with their own resources.

Those percentages, however, take the whole provinces, all of them as a unit. They do not consider the differences among provinces. Each group shows a very different situation regarding their own budget. For instance, in the group of central provinces, they cover their budgets with 49.9 per cent of their own resources; Patagonian provinces instead with 30.6 per cent and the Interior only 15.0 per cent. Federal transfers play a pivotal role in the provincial financing system. However, it is in the interior group where federal transfers are a more crucial variable. On average (2003-2010) the Interior provinces covered 85 per cent of their budgets with federal transfers.

While those numbers show a strong fiscal centralization, it is also true that only a small percentage of those transfers are earmarked for specific purposes: There are currently 22 federal funds, over which 18 are mandatory and earmarked to a specific purpose; three are mandatory and non-earmarked and only one is discretional and non-earmarked. Despite of the high number of these mandatory and earmarked federal transfers, they actually represent only 11 per cent of the provincial resources (on average from 2000 to 2010), while non-earmarked transfers represented 48 per cent of provincial budget.

As a consequence, Argentine provinces enjoy a high spending autonomy since non-earmarked grants represent on average 48 per cent of total subnational resources (65 per cent of total federal transfers). This autonomy ultimately translates into more decision-making power regarding their available resources (Altavilla 2020).

As a conclusion, (a) Argentine federalism is fiscally centralized, since nearly 90 per cent of current taxes are federal, and the federal administration collects 82 per cent of total country taxes. On average between 2000 and 2010, the provincial (including municipalities) share in total country revenues was 18 per cent (see Altavilla 2020); (b) as a consequence of this centralization, most of the provinces rely upon federal transfers: central provinces show some degree of autonomy from their own resources reaching almost 50 per cent of provincial budget, however, the remaining 19 provinces cover their budget with federal transfers in a range from 75 to 95 per cent; (c) despite this centralization, an important amount of federal funds are non-earmarked, especially those which come from the Co-participation regime, which represent nearly 68 per cent of total federal transfers and in total non-earmarked grants represent on average 48 per cent of total subnational resources.

Interregional Inequality

Decentralization put provinces in charge of most important and socially sensible policies; they are in charge of the implementation, the decision-making and the funding of policies such as education (primary and elementary), public health and housing – just to mention the most important ones. However, this process of decentralization did not establish where, when and how much provinces should expend in each of these services. Therefore, a first question arises: how much do provinces invest in each of these policies? And secondly, are investments similar across provinces? And how different is the investment across provinces?

In this section, we will compare the social policy expenditure of each of the 24 Argentine subnational governments in the three selected policies: education, health and housing (policies that are actually under provincial jurisdiction) and determine how different the investment between provinces is.

According to this work’s hypothesis, there should be a correlation between the lower spending on social policy X, and the high rate of socio-economic indicator Y. Interior provinces are those that invest the lesser percentage of their budget in each of the three policies (housing, health and education) and at the same time, they have the highest rate in each of the six socio-economic indicators. There is an inverse proportion: the less they spend, the more the indicators go up.

High Spending Autonomy with High Social Inequality

These numbers confirm the hypothesis. Decentralization has not contributed to improving provinces’ performance in the provision of social policies and inequality in their provision is high among provinces. Similar findings were reached by Bartolini et al. (2016: 7), in their study of 30 OECD countries for the period 1995-2011: “The vertical fiscal imbalance – an indicator of the share of spending not financed through own resources – is associated with larger regional disparities”.

The fact that those provinces which received more money from the centre are those which spend less in social policies, is a strong indicator of the absent coordination between levels of government.

However, the decentralization of tax competences in a context of high regional disparities may not be the most appropriate solution to consider, since poor regions will lose competitiveness with respect to better endowed provinces, thus increasing regional disparities (Bartolini et al., 2016). The solution, instead, would lay in keeping these transfer systems, but adding fiscal rules in order to orientate provincial spending. The 1994 constitutional reform introduced important changes to the distribution of competences and some rules[2]; however, these rules, are not mandatory, they are rather mere recommendations and guidelines to be taken into accounts by policy-makers.

The main problem in Argentine Fiscal Federalism is that there is not a comprehensive set of fiscal rules that orient public spending in some way that provision of these public good reach similar qualities and standards all around the country.

Research findings shows how different the socio-economic indicators among provinces are. There are a few isolated rules, which in most cases are not followed by provinces. The system is characterized by the non-compliance of rules and the lack of enforcement mechanisms.

Since the 1990s, federal and provincial governments have signed several agreements in fiscal matters. Those pacts, however, do not contain sanctions nor positive incentives for actors to comply. There are no constraints on actors’ behaviour. Most of the pacts benefited the federal government: each agreement recentralized even more the fiscal system. The federal government has been playing its own game, rather than an independent third party which coordinates the diversity of interest and conditions around the country. There are no observable parameters of equalization of the spending patterns on those different policies.

The problem, however, is not the transfers system. In countries like Argentina, where regional disparities are high and the fiscal system is centralized, the transfer system acquires a fundamental role. Unequal regional development determines the concentration of tax bases in some regions of the country and that is an obstacle to reach a full fiscal equivalence among the jurisdictions (Cetrángolo and Goldschmit 2013). Therefore, mechanisms of intergovernmental coordination of public policies are needed in order to reach some degree of equivalence. First, there is a need for the establishment of mechanisms of intergovernmental coordination and second, those mechanisms must take into account the existence of tensions among jurisdictions and their disparities (Cetrángolo and Goldschmit 2013).

Decentralization is thought to allow subnational units to provide public goods according to their citizens needs and preferences. However, in Argentina the result of decentralization was a fragmentation of these three main social policies, since their provision, quality and necessities are quite dissimilar among provinces.

The absence of clear fiscal rules undermines any redistributive policy, since that this “plus” that provinces receive in order to improve their situation, disappear, being redirected to other purposes and by the disorderly and undisciplined management of public resources.

[1] For instance, section 75.2 establishes that decentralization of functions and competences “it shall be based on principles of equality and solidarity giving priority to the achievement of a similar degree of development, of living standards and equal opportunities throughout the national territory”.

[2] Data from AFIP (Administración Federal de Ingresos Pùblicos), “Recaudación por jurisdicción (AFIP informe 4 trim 2015)”, p. 97, “Recaudación por jurisdicción política”. Available on: http://www.afip.gob.ar/estudios/archivos.

References

Altavilla, Cristian (2014) “Variables Políticas en la [Re]Distribución de Recursos Fiscales entre distintos niveles de Gobiernos”, Revista Perspectivas de Políticas Públicas, Año 4, N° 7, pp. 13-41.

Altavilla, Cristian (2016) Conflicto y Coordinación política en las Relaciones Intergubernamentales en Argentina. Un análisis neoinstitucional a través del Régimen de Coparticipación Federal de Impuestos, Doctoral Thesis, National University of Córdoba.

Altavilla, Cristian (2018) “Un análisis de las relaciones intergubernamentales en el federalismo argentino a 200 años de su independencia (1816-2016)”, Studia Politicæ, N° 45, pp. 117-153.

Altavilla, Cristian (2020) “Comparing Fiscal (De)Centralization and Multilevel Governments in Different Institutional Settings: A comparative study of Argentina and Denmark (2000-2010)”, European Autonomy and Diversity Papers (EDAP).

Bartolini, David, Sibylle Stossberg and Hansjörg Blöchliger (2016): “Fiscal decentralization and regional disparities”, OECD Economic Department, Working Paper No 1330.

Cetrángolo, Oscar and Ariela Goldschmit (2013) “La Descentralización y el financiamiento de políticas sociales eficaces: impactos, desafíos y reformas”, in Serie Macroeconomía del Desarrollo, Nº 144, Santiago de Chile: ONU-CEPAL and Cooperación Alemana.

CFI (Consejo Federal de Inversiones) (2014) “Luces y sombras del federalismo fiscal. Argentina y el mundo”, Informe Final, Mayo.

González, Lucas (2014) “Transferencias federales, desigualdad interregional y redistribución en América Latina”, América Latina Hoy, N° 67, pp. 167-190.

González, Lucas (2015) “When are Federations More Unequal? The Political Economy of Interregional Redistribution in Developing Federations” forthcoming, Studies in Comparative International Development (SCID).

Swenden, Wilfred (2006) Federalism and Regionalism in Western Europe. A Comparative and Thematic Analysis, Basingstoke: Palgrave.

Official sources

DAFI (Dirección de Análisis Fiscal y de Ingresos), https://www.mpf.gob.ar/dafi/.

DNAP (Dirección Nacional de Asuntos Provinciales), http://www2.mecon.gob.ar/hacienda/ssrp/

DNCFP (Dirección Nacional de Coordinación Fiscal con las Provincias – Ministerio de Hacienda y Finanzas Públicas), http://www2.mecon.gov.ar/hacienda/dncfp/index.php.

DNCFP (http://www2.mecon.gov.ar/hacienda/dncfp/index.php)

Ministerio de Economía, https://www.economia.gob.ar/peconomica,

Further Reading

Altavilla, Cristian (2021) “Federalism and Covid-19 in Argentina: Centralisation and Hyper-Presidentialism”, in Steytler, Nico (Ed.), Comparative Federalism and Covid-19. Combating the Pandemic, New York: Routledge, Taylor & Francis. With Antonio M. Hernández.

Altavilla, Cristian (2020): “Desafios do federalismo fiscal para a equidade social na Argentina e no Brasil”, in Aziz Tuffi Saliba e Dawisson Belém Lopes, (Coord.), Coleção Desafios Globais – Volume 3: América Latina – Área Temática: Saúde e Bem Estar, Belo Horizonte: Editora da UFMG. With Marcia Soares, pp. 221-251.

Altavilla, Cristian (2020): “Comparing Fiscal (De)Centralization and Multilevel Governments in Different Institutional Settings: A comparative study of Argentina and Denmark (2000-2010)”, European Diversity and Autonomy Papers (EDAP) 02/2020. EURAC Research Center Publication (Italy/Austria). Available on: http://www.eurac.edu/en/research/autonomies/minrig/publications/Documents/EDAP_20 20_02.pdf.

Altavilla, Cristian (2019) “Measuring fiscal descentralization in Argentina and Denmark”, Ars Boni et Aequi, Year 15, N° 1, pp. 31-53. Available on: http://www.arsboni.ubo.cl/index.php/arsbonietaequi.